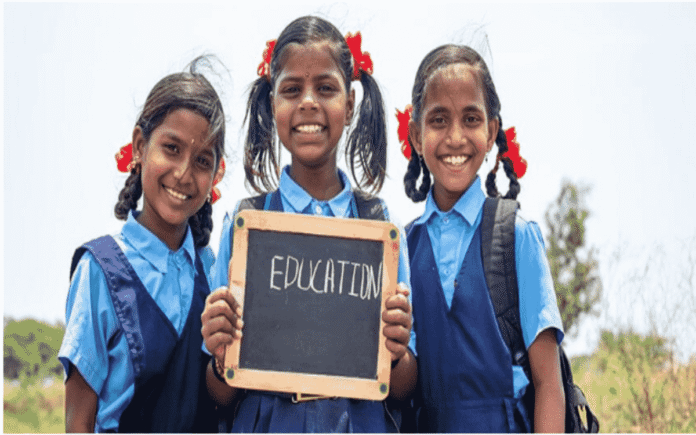

In today’s fast-evolving financial landscape, families in India must be well-informed about schemes that promote financial security, especially for their daughters. One such impactful scheme is the Ladli Laxmi Yojana, designed to encourage the education and welfare of girls. Coupled with government-backed savings methods such as the National Savings Scheme, families can create a robust financial foundation for their children’s future. This article aims to provide an in-depth understanding of the Ladli Laxmi Yojana, its importance, and how combining it with smart investment choices like Bajaj Finance FD can optimise returns and ensure financial stability.

What is Ladli Laxmi Yojana

Initiated by the Government of India, Ladli Laxmi Yojana seeks to improve the status of girl children in the socio-economic domain. It is primarily a financial incentive scheme for girls born in economically weaker sections, aimed at encouraging enrolment in education and reducing gender disparity. The scheme provides a fixed sum of money at different stages of the girl’s growth, such as birth, school enrolment, and adulthood, culminating in a maturity benefit once the girl turns 18 years.

This financial support helps families secure their daughters’ education and marriage expenses, thereby addressing inequalities and promoting gender balance. For many beneficiaries, Ladli Laxmi Yojana serves as a stepping stone towards a dignified and empowered future.

Key benefits of Ladli Laxmi Yojana for families

Understanding the advantages of Ladli Laxmi Yojana is crucial for families planning long-term financial security for their daughters:

– Financial aid at critical milestones: The scheme disburses payments at key stages such as birth, school admission (to encourage continued education), and maturity.

– Encouragement for girl child education: By linking payments with the girl’s continued schooling, it motivates families to keep their daughters in school.

– Reduced financial burden: It eases the economic pressure on underprivileged families.

– Long-term investment with assured returns: The maturity amount offered helps cover higher education or marriage expenses.

– Promotes gender equality: Incentives address socio-cultural barriers regarding the girl child.

With these benefits, families can build a secure financial plan early on, providing their daughters with greater opportunities and support.

How Ladli Laxmi Yojana complements the national savings scheme

The National Savings Scheme (NSS) is another government-backed investment plan offering guaranteed returns with a decent interest rate, typically used for mid to long-term savings goals. When combined with Ladli Laxmi Yojana, families gain an additional layer of financial security.

The synergy between Ladli Laxmi Yojana and the National Savings Scheme works in the following ways:

– Families can invest the maturity amount from Ladli Laxmi into NSS deposits for enhanced security.

– NSS offers risk-free fixed returns, complementing the lump sum received from Ladli Laxmi.

– The combination ensures liquidity, taxation benefits, and steady growth of funds.

– It helps families plan systematically for their children’s future education, marriage, and other significant expenses.

By utilising these two schemes strategically, families can create a diversified and secure financial portfolio.

Read Also: What Happens If You Miss the Renewal of a Fixed Deposit?

Investment options for families beyond government schemes

While government schemes provide a strong base, families should consider safer private sector financial products to maximise returns. One such option is the Bajaj Finance FD (Fixed Deposit), well-known for its competitive interest rates and reliability.

Why choose Bajaj Finance FD

Bajaj Finance FD is a prudent choice for families looking to invest in fixed deposits with assured returns. It caters to both senior citizens and general investors with differentiated interest rates. Here are some points that highlight its suitability:

– Attractive interest rates for different tenures, ranging from 12 months to 60 months.

– Special higher rates for senior citizens, reaching up to 7.30% p.a. for a tenure of 24 to 60 months.

– Flexible interest payout options including monthly, quarterly, half-yearly, and annual.

– Loans against FD facility, providing liquidity without breaking the deposit.

– Safety of principal with a reputed firm backed by strong financials.

These features allow families to strategically plan their investments alongside government schemes like Ladli Laxmi Yojana and National Savings Scheme.

How to utilise Ladli Laxmi Yojana maturity wisely with Bajaj Finance FD

Upon maturity, the amount received from Ladli Laxmi Yojana can be substantial. Investing this amount prudently ensures sustained financial growth for your daughter’s future needs. Here’s how families can maximise value:

– Consider placing the maturity sum in a Bajaj Finance FD to earn better interest than typical savings accounts.

– Choose tenure and mode of interest payout based on cash flow needs—monthly payouts for regular income or cumulative for lump sum growth.

– Leverage interest compounding by opting for longer tenures like 24 to 60 months where possible.

– Use FD against loans for emergencies without disturbing investment.

– Combine FD earnings with National Savings Scheme benefits to diversify risk and improve returns.

By planning this way, families ensure continuous financial support for their daughters, covering education, marriage, and other life events.

The significance of financial literacy in the Ladli Laxmi Yojana era

Financial literacy plays a crucial role in effectively leveraging schemes like Ladli Laxmi Yojana. Families must understand the nuances of:

– Scheme eligibility criteria and disbursement schedules.

– Benefits and limitations of the Ladli Laxmi Yojana versus other savings instruments.

– The advantages of government-backed schemes like National Savings Scheme alongside private financial products including Bajaj Finance FD.

– Tax benefits available under Section 80C for these investments.

– Creating a balanced portfolio that mitigates risks and ensures adequate liquidity.

Awareness and timely action can transform these schemes from mere social safety nets into valuable financial instruments that empower girl children economically.

Conclusion

For Indian families, knowing about Ladli Laxmi Yojana is vital in ensuring the financial security and empowerment of their daughters. When combined with the disciplined savings approach of the National Savings Scheme, and supplemented by reliable investment options like Bajaj Finserv FD, families can build a strong foundation for future needs. Bajaj Finance FD offers attractive interest rates—up to 7.30% p.a. for senior citizens and 6.95% p.a. for non-senior citizens—making it an ideal vehicle for investing the scheme’s maturity proceeds or any other dedicated savings. By understanding and leveraging these financial tools together, families not only secure the welfare of girls but also pave the way for a confident and independent future generation.